Real estate property investing has actually been regarded as by far the most productive approaches to build very long-phrase prosperity. No matter if you're looking for residual cash flow, cash progress, or portfolio diversification, assets delivers tangible Advantages that bring in each rookies and skilled traders alike.

Precisely what is Housing Investing?

At its core, property investing consists of purchasing Qualities—residential, commercial, or industrial—with the aim of creating money or income. This profits may well come from lease or while in the eventual sale Using the assets at the bigger selling price. Not like shares or bonds, property might be a Actual physical asset, which several buyers discover reassuring.

Critical Rewards

A person during the primary advantages of property investing may very well be the hazard of twin returns: frequent rental money and long-term cash appreciation. Additionally, buyers can leverage borrowed revenue to obtain house, that means you don’t need to have the comprehensive Expense upfront. With time, as tenants pay back down your property finance loan in addition to the property gains worth, your fairness grows.

Property also presents tax benefits, which include depreciation, unfavorable gearing Added benefits, and deductions for costs like curiosity, repairs, and residence administration fees. These aspects Blend to produce assets a tax-efficient investment decision motor vehicle for a lot of Australians.

Kinds of Property Investments

Household: Residences, units, and townhouses could be the most usual types of expenditure. They generally give steady rental demand from customers and therefore are much easier to take care of.

Commercial: Workplaces, retail Areas, and warehouses can yield increased returns but comes with extended vacancy durations moreover a lot more advanced lease agreements.

REITs: Real Estate Investment decision Trusts permit you to order property indirectly via shares in professionally managed property portfolios. This selection is outfitted to traders in search of contact with real estate devoid of possessing Actual physical get more info residence.

Crucial Factors

Prior to investing, it’s vital to exploration the nearby home market place, including need, infrastructure, and progress likely. Also consider your allowance, borrowing capability, and risk tolerance. Residence is not really a get-prosperous-fast scheme—it employs a long-term way of thinking, tolerance, and audio determination-creating.

Working with pros for example housing property brokers, banks, and economical advisors will allow you to make knowledgeable selections and stay away from popular pitfalls.

Conclusion

Real estate property investing continues to be just about by far the most trusted methods to create economic security and prosperity. With correct organizing, investigation, along with a clear strategy, assets will provide strong returns in addition to a secure path toward your financial aims.

Would you like this short posting tailored to possess an Australian viewers or for a particular type of investor?

Hallie Eisenberg Then & Now!

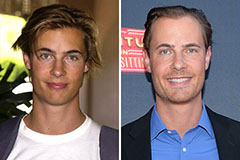

Hallie Eisenberg Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Batista Then & Now!

Batista Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!